Business Overview Reports

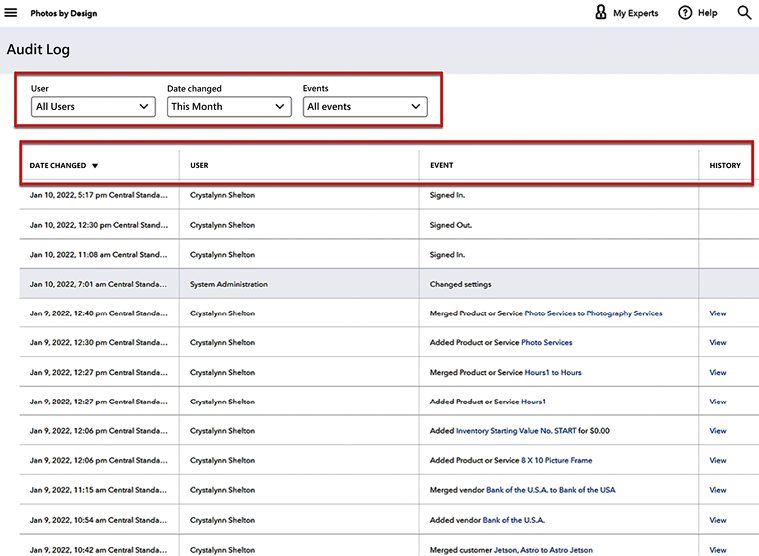

In Chapter 10, Report Center Overview, we explained how to navigate the Report Center, what reports are available based on your QuickBooks Online (QBO) subscription level, how to customize reports to meet your business needs, and how to export reports using Excel, PDFs, and Email. In this chapter, we will discuss the three primary reports that provide a good overview of your business: profit and loss statements, balance sheet reports, and statements of cash flows. We will explain what information is included in each report, how to customize it, and how to generate the report. In addition, we will learn how to create a budget from scratch so that you can keep track of your income and expenses in relation to the set budget for the year. This information will go a long way in helping you make decisions about your business. Finally, we will introduce you to the cash flow planner and the audit log report.

By the end of this chapter, you will have a better...